Earlier it was diamonds. Will it now be gold?

Storing India’s gold overseas today is quite an embarrassment

Policy watch

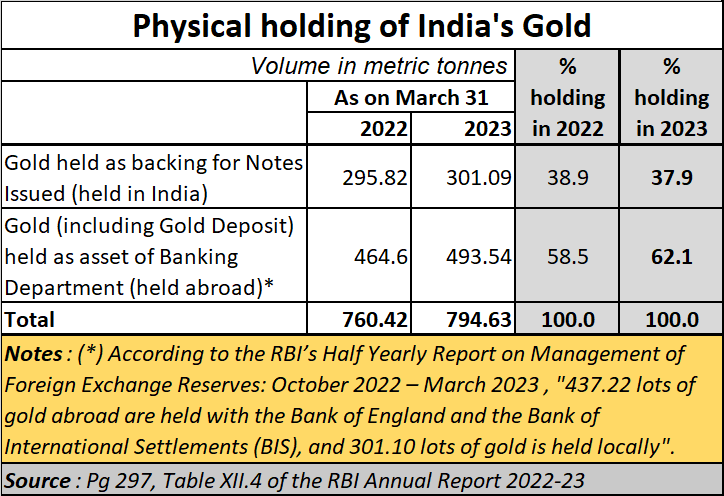

On 14 June 2023, RBI governor, Shaktikanta Das was honoured with the title of ‘Governor of the Year’ for 2023 by Central Banking in London (https://www.livemint.com/news/india/rbi-chief-shaktikanta-das-honoured-with-governor-of-the-year-award-at-central-banking-awards-2023london-11686723134489.html). In the same year, the RBI Annual report disclosed that India had increased its overseas holding of its total gold reserves from 59% in 2022 to 62% in 2023. So, is there a connection? We don’t know, but we hope not.

Colonial hangover?

But this discovery is truly startling. For years the government has railed against colonial mentality. It actually enjoys labelling any of its critics as people who still have a slavish mentality., and have not learnt that India is now an independent nation. Yet, despite such declarations, India stores its gold in the UK! The exact breakup between the UK and the BIS (Bank of International Settlements) is not known, but according to IAS Exam (https://www.iasexam.com/rbis-half-yearly-report-on-management-of-foreign-exchange-reserves/) “437.22 lots of gold abroad are held with the Bank of England and the Bank of International Settlements (BIS), and 301.10 lots of gold is held locally.”

Why should India hold its gold overseas? One explanation according to Imperial School of Banking and Management Studies (https://imperialbschool.com/2022/06/30/why-gold-reserves-are-held-in-foreign-country/) it could be because “the IMF and the world bank, where the US has a major influence, the BIS (Bank of settlements) is probably the safest foreign Agency. It is used by central banks all around the world to conduct business”. That’s really bizarre. Remember, how the UK seized all the bank accounts and assets of Russia last year without any UN resolution (https://www.reuters.com/world/uk/uk-eyes-seizing-property-sanctioned-oligarchs-ft-2022-03-02/)? It did so in violation of international banking rules, and possibly at the bidding of the US. Both threw global financial conventions aside just because they did not like Russia. Their argument has been that Russia had invaded another country. But why were those arguments not made when Iraq was invaded, or when Libya was pulverised, or when Afghanistan was taken over for a long time? Such duplicity does not inspire confidence.

Unsafe UK and the US

Suddenly, you realise that the UK and the US are not safe havens for banking or for depositing any money.

In fact, hats off to Germany, which recognised the risks of keeping its gold in US vaults. It is sad that such a vision was not shared by the present Chancellor who has bent backwards to accommodate the US and UK even by breaking up its links with Russia, which in turn has damaged its economy badly (https://www.bloomberg.com/news/features/2023-06-07/germany-labor-force-to-shrink-ending-era-of-rising-prosperity). After prolonged discussions, and despite pressures to refrain from taking back its gold, thanks to persistence on the part of Angela Merkel, Germany got what it wanted (https://www.dw.com/en/german-gold-repatriation-ahead-of-schedule/a-37477837).

Germany’s decision to keep its over 3,000 tonnes of its gold in the US after the Second World War was based on fears that they might fall into the hands of the Soviets in the event of a war. India faces no such fears. So why?

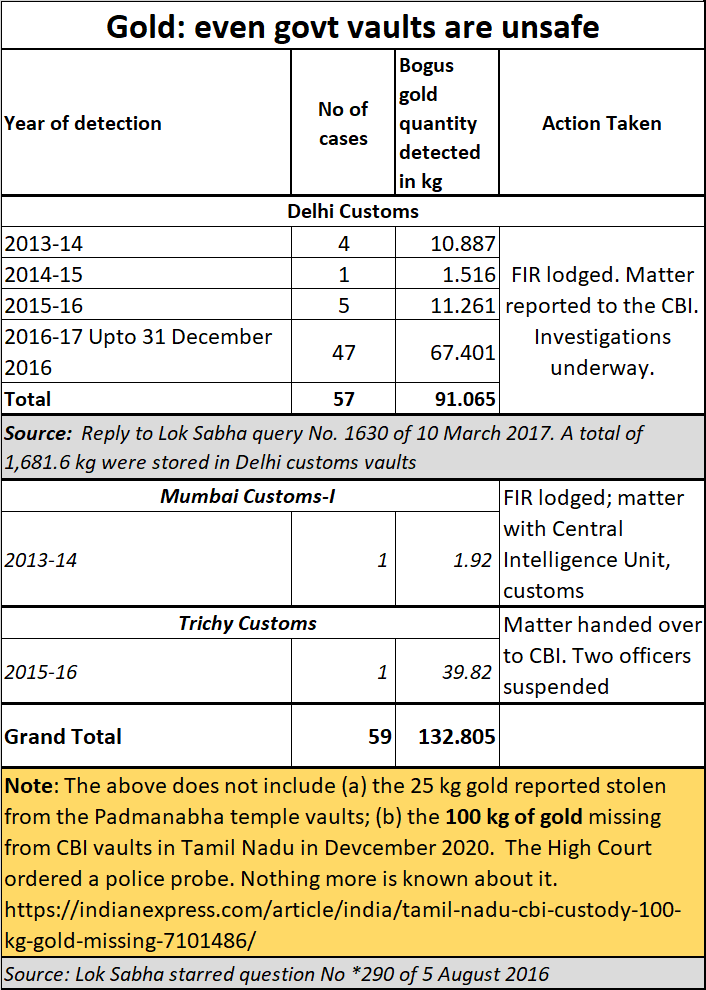

Was it because the government thought gold was unsafe in India? After all, gold has been stolen from the government’s own vaults, even as recently as in December 2020.

But then, do note that none of the gold in RBI’s vaults has been stolen. Gold has been stolen when proper controls were not there; when it was kept in independent vaults managed by the government agencies, not a professional banking body. Even today, the government has several vaults – with the Income Tax, customs, the CBI, and the Income Tax. All of them store gold. And many of them have discovered gold substituted with fake packages, or found it missing.

The answer to better security is to trust your bankers, and allow them to store gold in a single – or multiple – vaults under one management. Much of the theft is on account of decentralised systems, and political interference.

Such lax systems also lead to other types of disappearances. A good example is the disappearance of 1,760.65 Million ₹500 currency notes meant for the RBI (https://www.freepressjournal.in/mumbai/mumbai-news-mystery-of-176065-million-of-500-missing-notes-for-rbi).

De-dollarisation and gold

The fact is that India, like many other countries has been shoring up its gold reserves in the face of the shrinking popularity of the US$, the GBP and the Euro (especially after the Ukraine war. The decision to debar Russia and Iran from using the SWIFT mechanism for transfer of funds has actually wrecked the global financial system, leading more countries to seek out new ways of engaging in non-dollar financial transactions (free substack subscription --

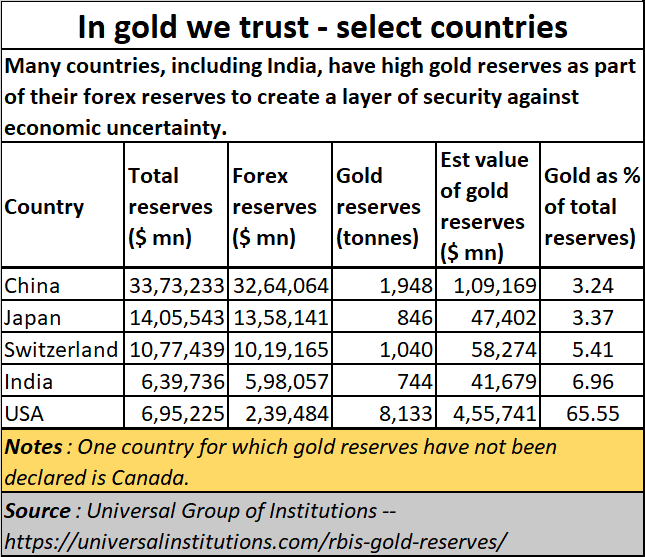

). Strangely, Canada does not seem worried about using gold reserves – data on its gold reserves (if any – are just not available. A list of countries and their gold holdings as of June 2022 can be downloaded from (2023-06-19_2022-06-06_World_official_gold holdings_as of_June 2022_IFS).

How much of financial reserves should be kept in gold is a decision each government takes for itself. China has only 3% of its total reserves in gold holdings. India is almost 7%. One possibility could be that China feels less vulnerable financially than India does. But with Germany and the US both having over 64% of their total reserves in gold holdings could mean that these countries may also be feeling vulnerable unlike China. Maybe, there are other factors at work as well. However, one thing is clear. Increasingly, many countries seek to increase the share of gold as part of their reserves. Most of them are reducing their holding in USD, GBP, and the Euro.

To that extent, India’s decision to increase its gold holdings seems a good move. But to increase its holdings overseas is mysterious to say the least.

Shunning India?

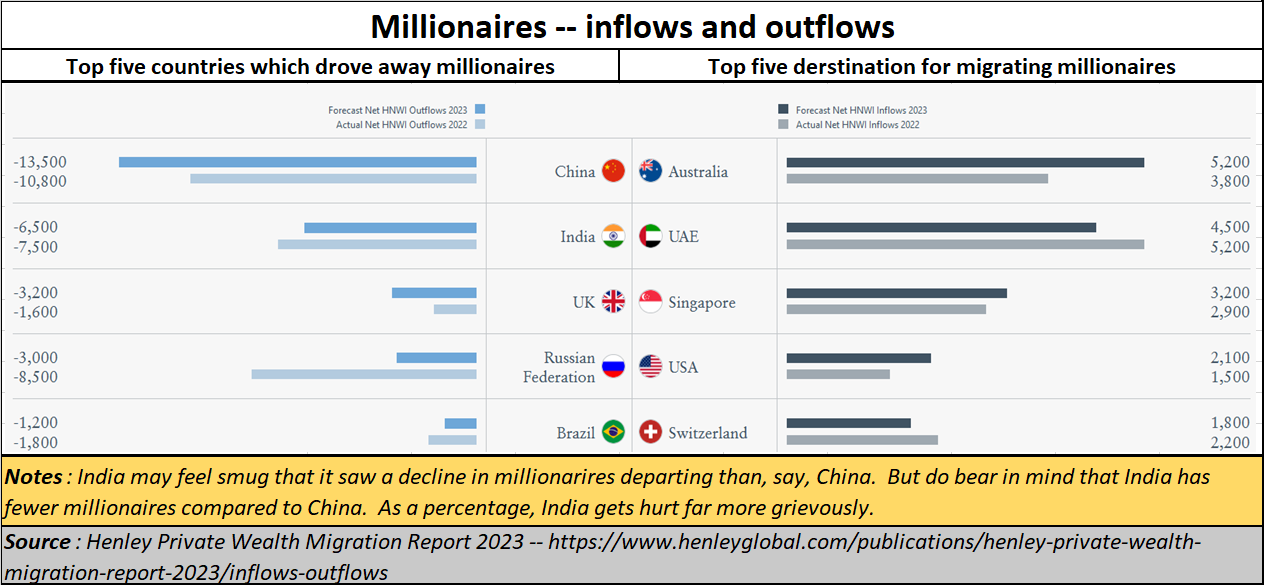

This unwillingness to trust Indians, and the willingness to trust UK or the BIS is one of the factors which has made many Indian millionaires leave India. Terrible rules for businesses, the revival of the police raj and greater security overseas have made them seek out other havens.

The latest compilation of numbers relating to millionaire migration can be got from the Henley Private Wealth Migration Report 2023(https://www.henleyglobal.com/publications/henley-private-wealth-migration-report-2023/inflows-outflows). They show how India has seen the second largest migration of millionaires out of their home country. China is larger, and the numbers appear to be swelling.

Indians may take comfort from the fact that its millionaire migration out of India is slowing down. But such cheer might be misplaced.

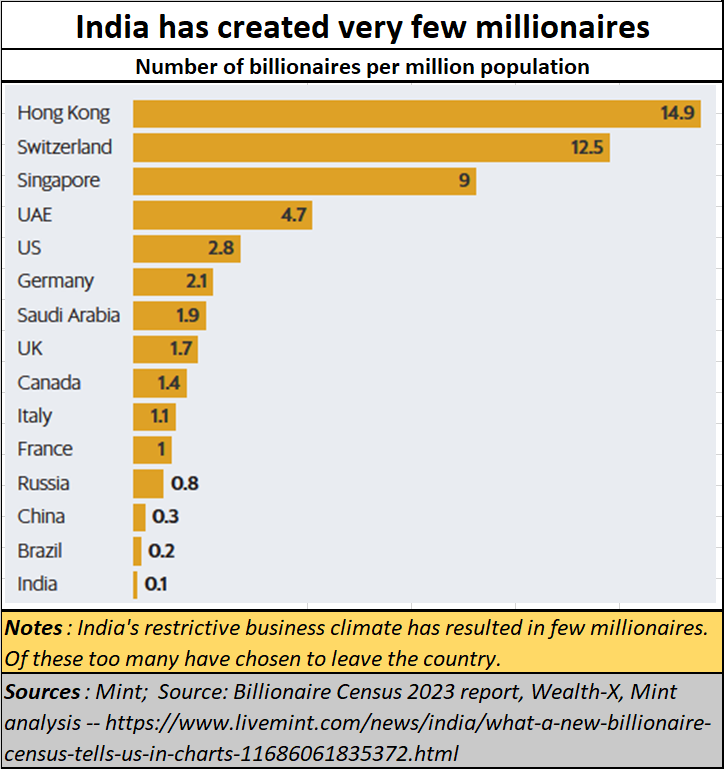

A further study will show that India has not created a climate for creating millionaires. It is almost at the bottom of the list of the countries selected. That is a blot on India’s claims that it is business friendly. So when millionaires leave India, it can be a disaster, because a large percentage of the few who could make it to the millionaire category has opted out (https://asiaconverge.com/2022/07/major-financial-turbulence-ahead-inr-may-weaken-further/). The number of Indian surrendering their passports is also increasing.

Al the numbers suggest that the business climate in India is not conducive for the growth of business. The decision of the government to increase its gold storage overseas is another blow to India’s swabhiman (self-respect) that the government likes talking about.

Storing Indian gold overseas is therefore a shocking travesty of all the claims India’s leaders make about shedding the ‘colonial; mindset, and atmanirbhart (self-reliance).

The author is a senior journalist and researcher

Keywords: #gold, #BIS, #UK, #US, #Russia, #Iraq, #Libya, #Afghanistan, #dollar, #GBP, #Euro, #vaults, #gold reserves, #Shanktikanta Das, #RBI, #colonial, #slavish, #Bank of England, #Germany, #Angela Merkel, #SWIFT, #CBI, #Enforcement Directorate, #Ukraine, #gold reserves, #forex reserves, #Canada, #Henley Private Wealth Migration Report, #China, #swabhiman, #atmanirbhar